By Tim Anderson

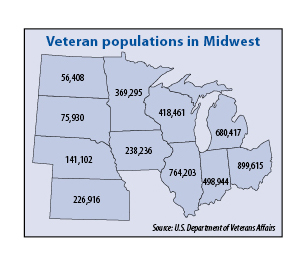

Every Midwestern state offers property tax breaks to certain disabled veterans, though the scope and amount of these credits and exemptions vary.

In two Midwestern states, the exemption is not specific to veterans with a disability. Iowa reduces the assessed value of a home (for property tax purposes) by $1,852 for all veterans. In Ohio, an exemption is available for all permanently and totally disabled homeowners; it applies to the first $25,000 of a home’s market value.

Legislation introduced this year in Ohio (SB 27) would provide a total tax exemption for properties owned by veterans who are 100 percent disabled due to an injury or illness that was incurred or aggravated during active military service. This disability rating is determined by the U.S. Department of Veterans Affairs.

Disabled veterans in Michigan qualify for the state’s Homestead Property Tax Credit. Also, homes that have been adapted to meet the needs of a veteran with a 100 percent service-connected disability are totally exempt from property taxes.

Illinois, Indiana and Minnesota offer broader exemptions, giving veterans tax breaks on a sliding scale based on their level of service-connected disability.

An Illinois veteran with a disability of between 50 percent and 69 percent qualifies for a $2,500 reduction in equalized assessed valuation. The reduction is $5,000 for someone with a disability of 70 percent or higher.

Indiana has different categories of property tax exemptions that may apply to disabled veterans. For veterans who served during wartime and have a disability of 10 percent or more, the maximum deduction is $24,960. It rises to $37,440 for veterans who have a disability of 100 percent or who are 62 or older with a disability of 10 percent or more. (Deduction levels are as of 2012.)

In Minnesota, the value of a home (for property tax purposes) is reduced by as much as $300,000 for individuals with a disability of 100 percent. It is cut by $150,000 for a veteran who is not totally or permanently disabled, but who has a disability of 70 percent or higher.

Nebraska uses a sliding income scale to determine the amount of each individual homestead exemption, which is only available to veterans with a 100 percent service-connected disability. Such veterans with incomes of less than $29,801 receive a full exemption. The percentage decreases as income levels rise; no tax relief is provided when income exceeds $36,700.

Like Nebraska, the property tax exemption in South Dakota extends only to those individuals with a 100 percent service-connected disability. The first $100,000 of a home’s value is exempt.

There is no limit to the amount that can be claimed in Wisconsin, where disabled veterans qualify for an exemption if they meet one of two federal criteria: 100 percent service-connected disabled, or a total inability to maintain gainful employment.

Kansas and North Dakota provide tax relief for veterans with a service-connected disability of 50 percent or more. Kansas offers a maximum tax refund of $300 to individuals with annual incomes of $32,400 or less. North Dakota’s property tax credit for disabled veterans applies to the first $120,000 of a home’s value; the amount varies depending on disability rating.